Owner Readiness

Owner Readiness Review

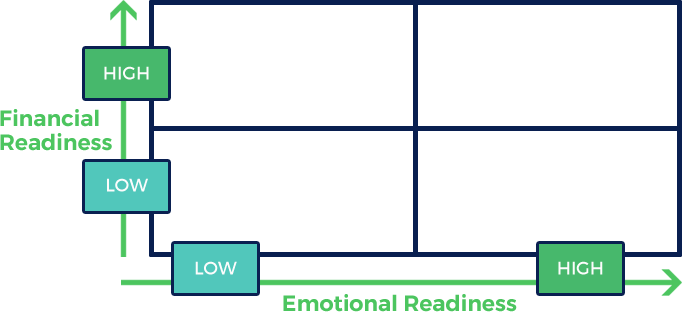

How prepared are you to exit? It is critical for us to understand the owner’s emotional and financial readiness for an exit.

Company Readiness

Company Readiness

How dependent is the company on you?

Most private equity investors and strategic buyers will agree that the biggest roadblock to selling a business in the lower middle market is its dependency on the owner.

Business & Financial Assessment

Business Wellness Checkup

This online Business Wellness Assessment is an initial evaluation that provides a glimpse into a broad range of practices to identify functional areas worthy of a deeper examination using targeted evaluations.

EvaluSys® offers a sophisticated, easy to use platform of online tools helping advisors develop more business, improve service delivery efficiency and scalability, and Guide clients to improve the profitability and enterprise value of their companies.

- Executive Leadership

- Business Planning

- Exit Planning

- Financial Planning & Control

- Human Resources

- Management / Supervision

- Sales

- Marketing

- Product/Service Innovation

- Business Process Quality

Recast Financials

Discover the true earnings of your company.

- Review and document 4-year historical financials and current year forecast.

- Normalize (recast) income and expenses to project the true earnings the acquirer will receive.

- Addback and adjust for owner perks, personal, and unusual or extraordinary business expenses.

- Prepare financials in a format attractive to larger acquirers and financial buyers.

Range of Values

The Estimate of Value (EOV)

Is a comprehensive report that includes all the components that support a “market based” valuation result.

- Our EOV methodology and results provide insight into your company’s value range that is comprehensive, professional and affordable.

- Utilizes recast financials to determine the financial value range of your business

- Includes an initial EOV and up to three annual updates at no additional cost.

Tax Optimization

- Determine the tax burden on the sale based on your entity type (C-Corp, S-Corp, LLC)

- Identify strategies to minimize taxes such as minority gifting, trusts, etc.

- Explore tax credits for manufacturers and others engaged in R&D

We will work with the client’s Accountant, trust attorney and/or Wealth Manager to explore strategies that may help the client reduce or delay tax burden upon a sale.

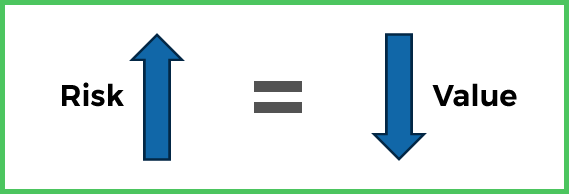

Acquirer Risk Assessment

What is the Acquirer’s perspective of risk and how do you mitigate against it?

This online Business Wellness Assessment is an initial evaluation that provides a glimpse into a broad range of practices to identify functional areas worthy of a deeper examination using targeted evaluations.

- Management team

- Supplier and customer contracts

- Retention of key employees and restrictive covenants

- Customer concentration issues

- Environmental issues

- Information technology

- Internal financial systems and processes

- Financial statements (compiled, reviewed, audited

Review and analysis by the advisor will prompt discussions with the business owner regarding these important topics.

There may be steps the owner can take will to mitigate any issues.

Transition Options

What are your best options and why? The advisor will explore and discuss the types of buyers in the marketplace with advantages and drawbacks of each including

- Strategic and Synergistic acquirers.

- Minority and Majority Recaps with Private Equity.

- Employee Stock Ownership Plan (ESOP).

- Estate & Gifting.

- Management Buyout (MBO).

Discussions with third party advisors may be required to determine if some of these options are viable such as.. ESOP, MBO and Estate/Gifting

The Touchstone Advisor will lead these discussions.

Assessment Recommendations

Scorecard with indications of weakness of functions areas that need improvement and recommendations.

- Scorecard with indications of weakness of functions areas that need improvement and recommendations.

- Based on the results of the assessments there will be several recommendations that will improve operational and financial performance.

- In a competitive sell-side process many of these improvements will result in higher offers.

In some cases, the ownership and/or management can implement and accomplish the recommendations themselves.

In other cases, it will require a TS Advisor consultant or outside consultant to assist.

Annual Performance Review

Are you heading in the right direction?  And when ready… Go to Market

And when ready… Go to Market

Mergers and Acquistions